What Is Cash App and Is It Safe to Use in 2025?

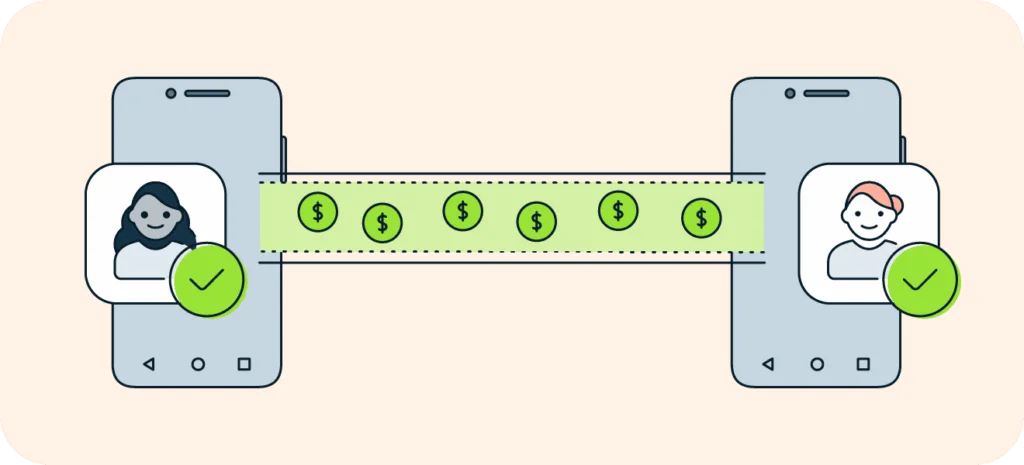

Cash App has revolutionized the way Americans send and receive money, but with over 50 million users trusting the platform with their financial transactions, safety concerns naturally arise. This comprehensive guide examines everything you need to know about Cash App’s security, features, and whether it’s the right payment solution for your needs.

What Is Cash App? Understanding the Popular Payment Platform

Cash App is a leading peer-to-peer (P2P) mobile payment application that has transformed digital money transfers since its launch in 2013. Originally introduced as Square Cash by Twitter co-founder Jack Dorsey, along with Jim McKelvey and Tristan O’Tierney, the platform has evolved far beyond simple money transfers.

Today, Cash App serves as a comprehensive financial services platform owned by Block, Inc., offering users the ability to:

- Send and receive money instantly

- Invest in stocks commission-free

- Buy, sell, and trade Bitcoin

- File taxes for free

- Use a linked debit card for purchases

The Rise of P2P Payment Apps

The popularity of mobile payment apps has skyrocketed in recent years. According to recent statistics, 61% of U.S. adults now use money transfer apps to simplify their payment processes. This surge reflects a broader shift toward digital financial services, with Cash App capturing a significant portion of this growing market.

Is Cash App Actually a Bank? Understanding the Financial Structure

Cash App’s Banking Status

Cash App operates as a “nonbank” fintech company, not a regulated financial institution. This distinction is crucial for understanding the platform’s limitations and protections. Unlike traditional banks, Cash App:

- Lacks a banking charter (license to operate as a bank)

- Doesn’t maintain physical branches

- Provides bank-like services through partnerships with regulated institutions

Key Banking Partnerships

Cash App collaborates with several established U.S. banks to deliver financial services:

| Partner Bank | Service Provided |

|---|---|

| Sutton Bank | Issues Cash App Cards (prepaid debit cards) |

| Wells Fargo | Holds user funds in pooled deposit accounts |

| Lincoln Savings Bank | Previously handled direct deposits (2016-2021) |

Additionally, Cash App’s investment services operate through Cash App Investing LLC, which maintains proper registration with:

- Financial Industry Regulatory Authority (FINRA)

- Securities and Exchange Commission (SEC)

Cash App Safety: A Detailed Security Analysis

Overall Safety Assessment

Cash App is generally safe for transactions with trusted individuals, but users should exercise caution when dealing with strangers or storing large amounts of money. The platform’s safety depends heavily on user behavior and understanding of its limitations.

Comprehensive Security Features

Cash App implements multiple security layers to protect user accounts and transactions:

1. Advanced Data Encryption

- End-to-end encryption protects financial information during transmission

- Secure data transfer even on public Wi-Fi networks

- Industry-standard encryption protocols

2. Two-Factor Authentication (2FA)

- Optional 2FA via email or text messaging

- One-time codes for enhanced account security

- PIN requirements for individual transactions

3. Biometric Security Controls

- Security Lock feature enables Touch ID and facial recognition

- Biometric authorization for transactions

- Device-specific security protocols

4. User Verification System

- Blue badge verification for authenticated users

- Requires legal name, date of birth, and partial Social Security number

- Reduces fraud risks through identity confirmation

5. Card Security Features

- Freezable Cash App Cards for lost or stolen card incidents

- Immediate card locking capabilities

- Direct support reporting system

6. Transaction Monitoring

- Unusual activity detection with automatic transaction cancellation

- Real-time notifications for suspicious behavior

- Confirmation requirements for international transfers and new device logins

Advantages of Using Cash App: Why Millions Choose This Platform

Key Benefits for Users

| Feature | Description | Value Proposition |

|---|---|---|

| Instant Transfers | Most transactions complete immediately | Perfect for urgent money needs |

| Commission-Free Investing | Stock investments without fees | Access to market with expert tips |

| Free Tax Filing | Federal and state tax preparation | Maximum refund guarantee |

| Bitcoin Trading | Cryptocurrency transactions (1-3% fees) | Competitive crypto exchange rates |

| Cash App Card | Visa debit card with cashback rewards | Enhanced fraud protection |

Convenience Factors

Cash App excels in everyday scenarios:

- Bill splitting at restaurants or group activities

- Rent payments between roommates

- Emergency money transfers when traditional banks are slow

- Small business payments for services

Potential Drawbacks and Limitations

Transaction Fees and Limits

Fee Structure

- Instant Transfer Fee: 0.5%-1.75% of transaction amount

- Minimum Fee: $0.25 for instant transfers

- ATM Withdrawals: $2.50 per transaction

- Credit Card Funding: 3% fee

Account Limits

- New Users (30 days): $1,000 sending/receiving limit

- Lifetime Limit (Unverified): $1,500 total

- Verified Users: Up to $20,000 monthly sending, $25,000 receiving

Geographic Restrictions

Cash App operates exclusively within the United States, limiting its usefulness for:

- International money transfers

- Overseas business transactions

- Travel-related payments abroad

Understanding the Risks: What Users Need to Know

Limited Buyer Protection

Unlike traditional banks or credit cards, Cash App offers minimal protection against fraud and scams. Key vulnerabilities include:

- No refund policy for fraudulent transactions

- Irreversible transfers to scammers

- Limited dispute resolution compared to credit card chargebacks

Statistical Risk Data

According to Pew Research findings:

- 13% of users have experienced scams on P2P payment platforms

- 11% of users report account hacking incidents

- Cash App Card transactions offer better protection than in-app transfers

FDIC Insurance Limitations

Cash App balances receive limited FDIC protection:

- Insurance only applies to Cash App Card holders or Sponsored Account users

- Standard app balances remain uninsured

- Risk of total loss if Cash App faces financial difficulties

The Consumer Financial Protection Bureau warns that funds held in payment apps face greater risk compared to traditional FDIC-protected bank accounts.

Security Breach History

Cash App has experienced significant security incidents:

- 2022 Data Breach: Former employee accessed customer data

- 2023 Security Incident: Additional data compromise

- $175 Million Settlement: Block, Inc. penalty for weak security procedures

Best Practices for Safe Cash App Usage

Essential Security Measures

- Restrict Transactions to Trusted Contacts

- Only send money to verified friends and family

- Avoid off-platform payments on eBay, Mercari, or similar sites

- Be wary of merchant requests for Cash App payments

- Enable All Security Features

- Activate two-factor authentication immediately

- Set up biometric locks for transactions

- Use PIN protection for all transfers

- Practice Strong Password Hygiene

- Create unique, complex passwords

- Consider using a password manager

- Never reuse passwords across platforms

- Monitor Account Activity Regularly

- Check transaction history frequently

- Set up account notifications

- Report unauthorized transactions immediately

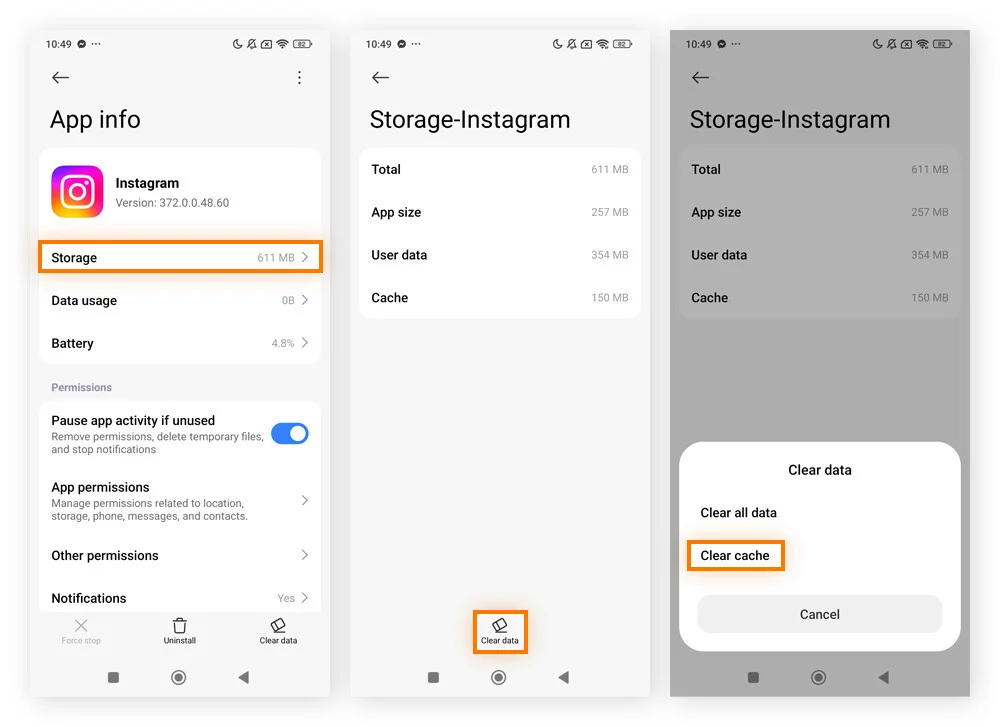

- Maintain Device Security

- Use only trusted, personal devices

- Keep the Cash App updated with latest versions

- Log out completely after each session

Recognizing Common Scams

Stay vigilant against these frequent Cash App scams:

- Fake verification fees requests

- Too-good-to-be-true investment opportunities

- Romance scams involving money requests

- Tech support impersonation attempts

- Phishing messages requesting account information

Cash App Alternatives: Comparing Your Options

Major Competitors Analysis

| Platform | Key Features | Best For |

|---|---|---|

| Venmo | Social media integration, Teen accounts | Social payments, younger users |

| Zelle | Bank integration, free instant transfers | Traditional banking customers |

| PayPal | International support, buyer protection | Online purchases, global transactions |

| Google Pay | Android integration, loyalty programs | Google ecosystem users |

| Apple Pay | iOS integration, privacy focus | iPhone users, security-conscious individuals |

When to Choose Alternatives

Consider other platforms if you need:

- International money transfers

- Enhanced buyer protection

- Integration with existing bank accounts

- Business payment processing

Frequently Asked Questions About Cash App Safety

What are Cash App’s current transaction limits?

Unverified Users:

- $1,000 per 30-day period

- $1,500 lifetime limit

Verified Users:

- $20,000 monthly sending limit

- $10,000 weekly sending limit

- $25,000 monthly receiving limit

- $12,500 weekly receiving limit

How much does Cash App charge for transactions?

Current Fee Structure:

- Standard transfers: Free (1-3 business days)

- Instant transfers: 0.5%-1.75% (minimum $0.25)

- ATM withdrawals: $2.50

- Credit card funding: 3%

- Bitcoin transactions: 1-3% variable fee

- Business payments: 2.75%

What happens if Cash App refunds a payment?

Refund processing times vary:

- Cash App to Cash App: Instant refunds

- Bank/Debit card sources: 1-3 business days

- Automatic notifications confirm refund processing

Is Cash App considered a checking account?

No, Cash App functions as a financial services platform, not a traditional checking or savings account. While it offers similar features, it lacks the regulatory protections of chartered banks.

The Bottom Line: Is Cash App Right for You?

Cash App serves as a convenient solution for small, personal money transfers between trusted individuals. Its expanded features like stock investing, tax filing, and Bitcoin trading add significant value for users seeking a comprehensive financial platform.

However, the platform’s limitations—including minimal buyer protection, limited FDIC insurance, and vulnerability to scams—make it unsuitable as a primary banking solution or for large financial transactions.

Use Cash App when:

- Sending money to trusted friends and family

- Making small, low-risk transactions

- Accessing commission-free stock investing

- Filing simple tax returns

Avoid Cash App for:

- Large money transfers or storage

- Purchases from unknown merchants

- International transactions

- Primary banking needs

By understanding these guidelines and implementing proper security measures, you can safely leverage Cash App’s convenience while minimizing potential risks.